- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

In daily life, whether at home, during travel, or for personal care, wipes have become an essential item. Whether its facial cleansing wipes, oral wipes, or disinfectant wipes, market demand is growing year by year. However, for businesses, how can they correctly classify these wipes for customs declaration?

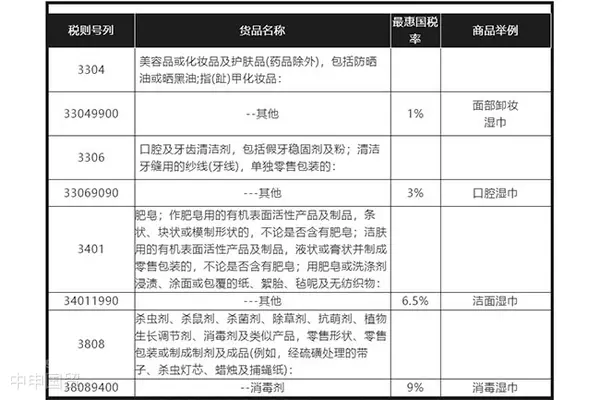

I. Relevant HS Codes and Import Duty Rates

When importing wipes, the first step is to clarify the relevant HS codes and import duty rates, as this is the foundation of customs declaration.

II. Wipes Classified Under Heading 33.04 to 33.06

Pure Facial Cleansing Wipes

The primary function of these wipes is makeup removal. Based on their liquid composition and use, they can be classified under HS code 3304.9900, with a most-favored-nation import duty rate of 1%.

Oral Wipes

These wipes are mainly used for cleaning infants mouths. Because their liquid composition primarily consists of purified water and plant extracts, they can be classified under HS code 3306.9090, with a most-favored-nation import duty rate of 3%.

III. Wipes Classified Under Heading 34.01

Baby Wipes:These wipes are specifically designed for infants to clean their skin. Since they do not contain disinfectant ingredients, they can be classified under HS code 3401.1990, with a most-favored-nation import duty rate of 6.5%.

IV. Wipes Classified Under Heading 38.08

Disinfectant Wipes:The primary function of these wipes is sterilization and disinfection. Due to their ability to kill various bacteria and viruses, they can be classified under HS code 3808.9400, with a most-favored-nation import duty rate of 9%.

Forimport and exportFor businesses, correct customs classification not only ensures smooth market entry for wipes but also helps companies save unnecessary tax expenses. Therefore, businesses must familiarize themselves with and master these classification rules.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912